[Equity research report] Yesun tech, New star of OLED industry that expected in the future

December 12, 2021 | Equity Research

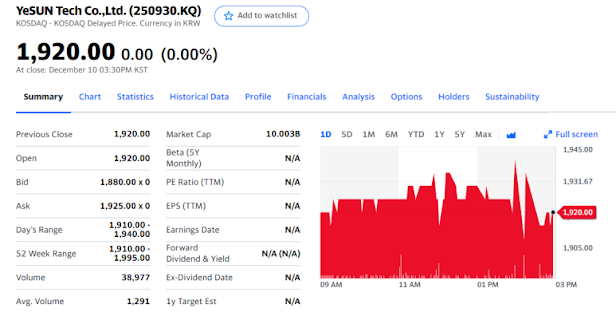

Yesun Tech [Kosdaq (250930)]

Holding until 4Q earning improvement

Yesun tech's summary - by yahoo

Yesun tech Financial highlight (Unit 1=0.085 M$)

- Yesun Tech starts supplying OLED TVs to LG Electronics

Yesun Tech is a company that manufactures functional adhesive materials and has the largest market share among LG Electronics and display adhesive material suppliers.

It is expected to benefit from the increasing share of OLED TVs in the TV market.

This year, it was registered as a LG OLED material and parts company through an Indonesian corporation, and it will participate as an OLED TV developer from the 2022 year.

In fact, in the second quarter of this year, Yesun Tech's OLED sales increased 40% YoY to 7.4 billion won, which is presumed to be due to increased TV demand due to the prolonged Covid 19.

- Pay attention to another attraction of YesunTech.

YesunTech produces adhesive materials necessary for LCD-related products, products for the automobile market and the energy market, so it has the advantage of complying with the Korean Green New Deal policy such as secondary batteries in the future.

In addition, as Covid 19 continues for a long time, the consumption of devices for consuming untact content such as tablets, computer monitors, and TVs increases, and the demand for adhesive materials required to make them is expected to increase naturally.

As the global pandemic continues in Southeast Asia, online classes are held, and the demand for devices, that is, adhesive materials, required for this purpose, centered on the upper and middle classes, is also expected to have a positive effect on export performance.

- Expected to improve in the fourth quarter.

3Q consolidated sales and operating profit were KRW 16.4 billion (-7.3% YoY) and KRW -100 million (turn to deficit), respectively.

YesunTech recorded 33.1 billion won in sales in the first half, of which 4.9 billion won in Korea, 18 billion won in China, 7 billion won in Vietnam and 3.2 billion won in other regions.

85% of sales are generated overseas, and China accounted for the largest share of sales by region with 54.5%.

This suggests that the company's sales are highly likely to be severely affected if China risks arise from the U.S-China trade conflict in the future.

The sluggish performance in the first half of the year was due to problems with supplier registration and the volume burden caused by the bankruptcy of competitors.

However, due to industry restructuring, the company has left a significant performance of expanding its market share, and along with the growth of the OLED TV market, the start of supplying insulators for shock mitigation to domestic secondary battery manufacturers will also have a positive effect in the 4Q.

- The stock price gets out of box pattern and continues to falling

Yesun tech 's day candle chart

The stock price currently trades at a 12-month Fwd PER 79.2 and gets out of Box pattern and continues to falling.

Considering the future earnings improvement, this is an attractive position.

This year's stock price has been in the long-term sideways range between 2,350 won and 2900 won, and has now fallen to the 1900 range.

It is likely to be accumulated buy over the long term, given the decrease in trading volume when it is adjusted after an uptrend.

From a long-term perspective, I recommend holding the investment until 4Q earnings improvement, and from a short-term perspective, I recommend swing trading using the 20-day line,

and present a target price of 3,300 won when earnings improve.

댓글

댓글 쓰기